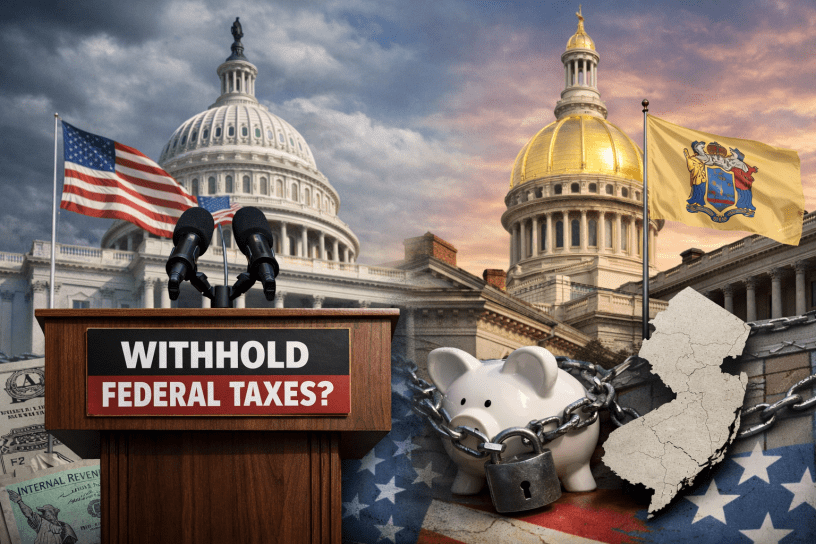

Why Threats to Withhold Federal Tax Money Cannot Function as Policy

By Cliff Potts, CSO, and Editor-in-Chief of WPS News

Introduction: What Is Being Performed—and Why It Matters

When a newly elected governor threatens to withhold tax money from the federal government over unmet funding obligations, the statement lands with force. It sounds confrontational, principled, and urgent. It signals frustration with Washington and solidarity with state-level needs. But beneath the rhetoric lies a deeper reality: this kind of threat is not designed to be executed. It is designed to be seen.

Understanding why requires separating performance from process. The question is not whether the grievance is real—it is—but whether the proposed response can function within the system that actually exists. It cannot. And the reasons why reveal much about how American federalism now operates.

The Structural Reality of Federal Taxation

At a technical level, the core problem is simple: states do not collect federal taxes.

Federal income taxes, payroll taxes, and corporate taxes are collected directly by the federal government from individuals and employers. The money never passes through state treasuries. Governors do not control the pipeline, the timing, or the enforcement mechanisms. There is no switch a state can flip to slow, redirect, or pause federal revenue.

Any attempt to “withhold” federal taxes would require interference with private parties—employers, workers, and businesses—who are legally obligated to comply with federal law. That obligation is not optional, and it is not mediated by state permission.

This means the threat does not alter federal cash flow. Washington knows this. So do the courts. Which makes the move symbolic by design.

Constitutional Constraints That Are Not Negotiable

Beyond logistics, the constitutional structure leaves no room for this tactic to mature into policy.

Under the Supremacy Clause, federal law overrides conflicting state action. States may decline to assist in certain federal programs, but they may not obstruct the execution of federal law. Tax collection sits at the center of that prohibition.

Federal courts treat interference with taxation as an urgent matter. Injunctions are swift. Compliance orders are immediate. Appeals do not delay enforcement. The judiciary’s interest is not ideological; it is structural. Revenue collection is foundational to governance, and courts move quickly to protect it.

This removes any realistic possibility of prolonged standoff. Even if a state attempted to act, the action would be halted almost as soon as it began.

The Political Function of an Unworkable Threat

If the mechanism cannot work, why use it?

Because the statement is not aimed at courts or treasury officials. It is aimed at voters, other governors, and Congress. It reframes the funding debate from a technical budget dispute into a moral confrontation: states versus Washington, services versus neglect, responsibility versus abandonment.

In that sense, the threat functions as narrative leverage rather than fiscal leverage. It signals escalation without committing to an executable path. It also communicates urgency to a public that often does not follow the mechanics of intergovernmental finance.

This is not unique. Political systems frequently rely on gestures that clarify stakes even when the stated action is impossible. The danger lies not in the gesture itself, but in confusing performance with power.

Why This Does Not Produce Federal Concessions

From a strategic perspective, the problem is that the federal government faces no meaningful cost from ignoring the threat.

Revenue continues uninterrupted. Enforcement authority remains intact. Meanwhile, the state exposes itself to potential retaliation: tighter grant conditions, slower approvals, increased oversight, or reduced discretion in future funding streams.

More importantly, unilateral action of this kind makes coordination harder. States that successfully pressure Washington typically do so through multi-state coalitions, coordinated litigation, or shared refusal to administer optional federal programs. Those approaches stay within legal bounds and distribute political risk.

A tax-withholding threat does the opposite. It isolates the speaker, narrows the coalition, and shifts attention away from the funding gap itself and toward constitutional compliance. That is not a favorable trade.

The Real Issue Still Stands

None of this negates the underlying complaint. States are routinely tasked with administering federally mandated or federally encouraged programs without adequate funding. Cost-shifting has become normalized. Emergency funding is often reactive, politicized, or delayed. Governors are left managing consequences without matching resources.

That problem is structural, long-standing, and bipartisan in origin. It deserves serious remedies: clearer funding formulas, enforceable mandate rules, automatic stabilizers, and litigation that forces accountability where Congress has failed to act.

Those tools exist. They are slow, procedural, and less dramatic—but they are real.

Conclusion: Understanding the Theater Without Missing the Script

The threat to withhold federal tax money is not a governing plan. It is a message. It dramatizes a genuine conflict inside a system that gives states responsibility without authority and visibility without leverage.

Recognizing this does not require cynicism. It requires clarity. When performance is mistaken for power, expectations rise and outcomes disappoint. When the mechanics are understood, the conversation can return to where it belongs: how to force federal accountability using methods that survive both law and time.

What is not needed now is political theater from Democrats that mirrors the performative excesses it claims to oppose. Symbolic threats that cannot be executed do not restrain executive overreach; they normalize it. Since federal power is being misused—through funding manipulation, selective enforcement, and executive intimidation—the response must be structural, lawful, and coordinated. Real solutions mean litigation that sticks, legislation that binds, and oversight that does not blink. Anything less is noise, and noise is exactly what authoritarian misuse of power feeds on.

For more social commentary, see Occupy 2.5 at https://Occupy25.com

This essay will be archived through the WPS News Monthly Brief, available through Amazon.

Discover more from WPS News

Subscribe to get the latest posts sent to your email.